// Customer Information Bulletin

Customer Information Bulletin #98- Mar 2007

Generic mortgage forms

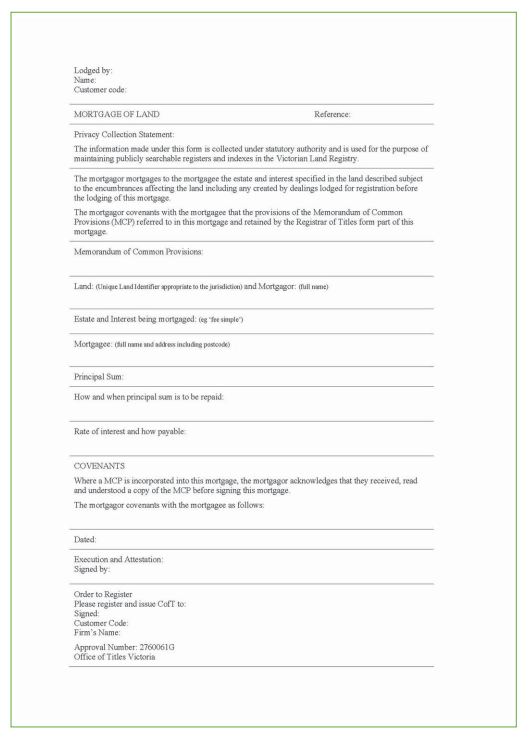

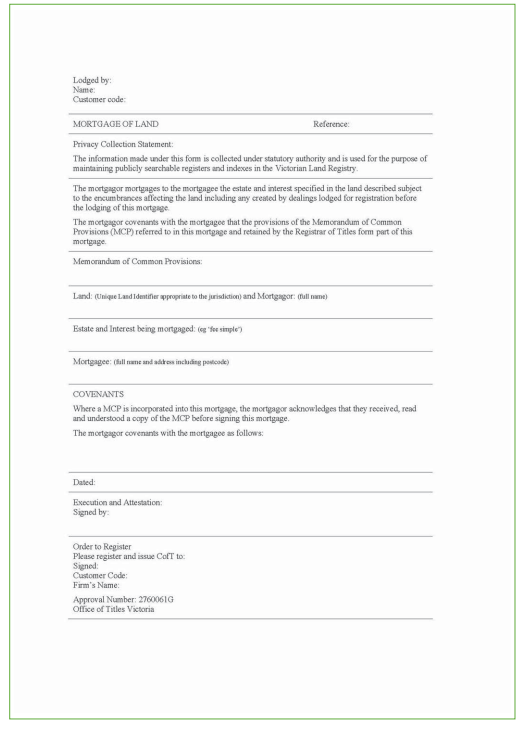

The Registrar of Titles recently approved two new generic mortgage forms that can be used to lodge mortgages in either the Electronic Conveyancing (EC) system or in paper format.

The forms — a principal sum mortgage form and an all monies mortgage form — both have the approval number 27600610G.

In the EC system the forms will be used for digital mortgage instruments signed by the mortgagee and will be lodged electronically.

The Registrar will also accept both generic forms for lodging in paper, subject to the usual examination process. Samples of the forms are detailed on pages 2 and 3 of this bulletin.

In order for the Registrar to examine paper generic mortgages, and for them to be easily searchable once registered, customers are required to:

- use Approved Forms 27600610G (principal sum and all monies generic mortgages)

- use a laser printer to print the forms

- use a laser printer or ink to complete the forms

- use black ink when printing the forms and their contents

- use black or blue ink when completing the forms by hand

- ensure that all signatures and hand-writing are in ink

- only print on one side of a page

- print in portrait

- use size A4 paper

- use white paper

- use paper of not less than 80gsm

- allow for a Land Registry label in margins in the top right-hand corner of each page; dimensions 40mm by 50mm

- left, right and bottom margins should be 10mm

- use Times New Roman font

- font size of 12 point

- staple the pages together in the top left-hand corner if a mortgage contains more than one page; binding is not acceptable

- number pages at the bottom right of each page if a mortgage contains more than one page, for example 1 of 4, 2 of 4, 3 of 4 and 4 of 4, as applicable

- include, where required, the financial institution’s reference on each page in the left-hand corner of the footer

- not use white out or any other impermanent medium

- refrain from making pencil notations on the mortgages

The Registrar will also continue to accept all other existing approved mortgage forms in paper format.

Telephone enquiries

It is important to Land Victoria that we provide prompt, consistent answers to queries from our customers and collate all enquiries we receive.

To ensure a smooth process for all telephone enquiries, including legal enquiries, customers are asked to call Customer Services on 8636 2010.

If required your call will be forwarded to a specific area, or an email will be sent to the appropriate person to ensure you receive the correct information.

Sample Generic Mortgage Form (Principal sum)

Sample Generic Mortgage Form (all Monies)

Considerations in transfers and duty assessed

The Registrar has a duty to ensure that the appropriate lodging fees are paid. In determining lodging fees, staff are required to assess the true consideration. To do this, they will review what is stated in the consideration panel, the parties’ intent, and any subsequent notation.

Where the consideration stated is as a “gift” or “natural love and affection” and the parties appear to be related, the dealing may be exempt from duty. If the parties do not appear to be related, duties may be raised, and inquiries made.

Where the consideration is expected to be an agreement (whether the parties are related or not) and it appears that there is a monetary component that has been omitted or that there is a non-monetary component which should be fully explained. As a result, the dealing will be refused and both parties or their Australian Legal Practitioner(s) will be asked to clarify the situation and make any necessary amendments. To avoid such a refusal, it is suggested that the consideration be expressed to make the position completely clear.

Where consideration expressed is monetary but the duty assessment shows a higher consideration (whether or not the parties appear to be related), staff will inform the customer there is a mistake in the consideration panel (e.g. a typographical error or that GST has been omitted). If the matter is not corrected or clarified, the transaction will be refused, and inquiries will be made.

First mortgagee’s consent to registration of a plan of subdivision

Section 221(a) of the Subdivision Act 1988 requires the consent of the parties listed in Section 221(a) before the registration of a Plan of Subdivision. Traditionally, a written consent has been sought from a relevant party. If that party does not have the relevant consent, it must be obtained prior to the endorsement of an Order to Discharge the Application for Plan Registration and the Certificate of Title.

Having regard to the provisions of Section 221(a)(8) of the Act, the Registrar, once having confirmed a registered first mortgage, will cease requiring any further consent from the registered owner or any other party bound by or in receipt of the registered mortgage.

The Order to Register must clearly reflect this and give clear explanations and directions as to the owners who will receive Certificates of Title. Customers should note that a formal consent from second and subsequent mortgagees or other encumbrance holders is still required.

Evidence requirements in Section 221(B) applications

Section 221(B) of the Subdivision Act 1988 provides that where a person who is required to consent to the registration of a plan has not consented, the applicant may apply to the Registrar for service on that person of a notice under sub-section 1(C).

It is a pre-requisite to the use of Section 221(B) that consent first be sought. The Registrar considers that the intent of the section is to facilitate plan registration in circumstances where consent has been sought but was not obtained or refused.

Accordingly, future applications under Section 221(B) must be accompanied by a Statutory Declaration as to the efforts made to comply with that party’s consent. The statutory declaration should:

- specify the party whose consent was sought and their details

- specify in writing (on a date) and the written evidence signed or endorsed by that party

- describe how addresses of the owner were confirmed (personal knowledge, telephone book, local land authority, etc.)

- if consent is not the current address, state how inquiries were made to last known address and visits made to the address

- not list inquiries made only in telephone book, Internet, etc.

- specify the response to the notifier—either no response or a refusal of consent.

Return to the Customer Information Bulletin Index

Disclaimer

The Customer Information Bulletins (CIB) Search Tool (“Tool”) is provided by SERV to assist users in locating Customer Information Bulletins (CIBs) issued by Land Use Victoria (https://www.land.vic.gov.au/land-registration). This Tool provides a list of available CIBs based on search terms entered by users, displaying results in order from newest to oldest.

By using this Tool, users agree to these terms and acknowledge that SERV makes no warranties regarding the accuracy, completeness, or timeliness of the search results. Users accept responsibility for verifying the information obtained through the Tool against the original sources, including the official Customer Information Bulletins found here (https://www.land.vic.gov.au/land-registration) and any other requirements issued by the Registrar of Titles from time to time in accordance with the Transfer of Land Act 1958.